Your deal rarely dies on price. It dies on legitimacy.

You can have the best commercial case in the room and still lose because one quiet stakeholder decides the agreement is not clean to sign.

Call it INFP if you want. I call it what it is: a legitimacy gate.

Gandhi did not beat an empire by matching force. He attacked the one asset every empire depends on: the right to be obeyed.

In B2B negotiations, the same mechanism shows up when a stakeholder can kill a deal without touching the spreadsheet.

■ The Legitimacy Gate: the “soft” stakeholder who can break a contract

This profile is routinely misread as:

- “Too idealistic”

- “Too reserved to matter”

- “Not commercial”

That misread creates margin leakage, late-stage rework, and silent vetoes.

Why? Because they do not compete on authority levers.

They compete on conviction levers.

They are the person who says:

- “We cannot defend this internally.”

- “This structure is manipulative.”

- “This supplier is not clean.”

- “This clause is unfair.”

They do not fight you in the meeting.

They kill the deal in the workflow.

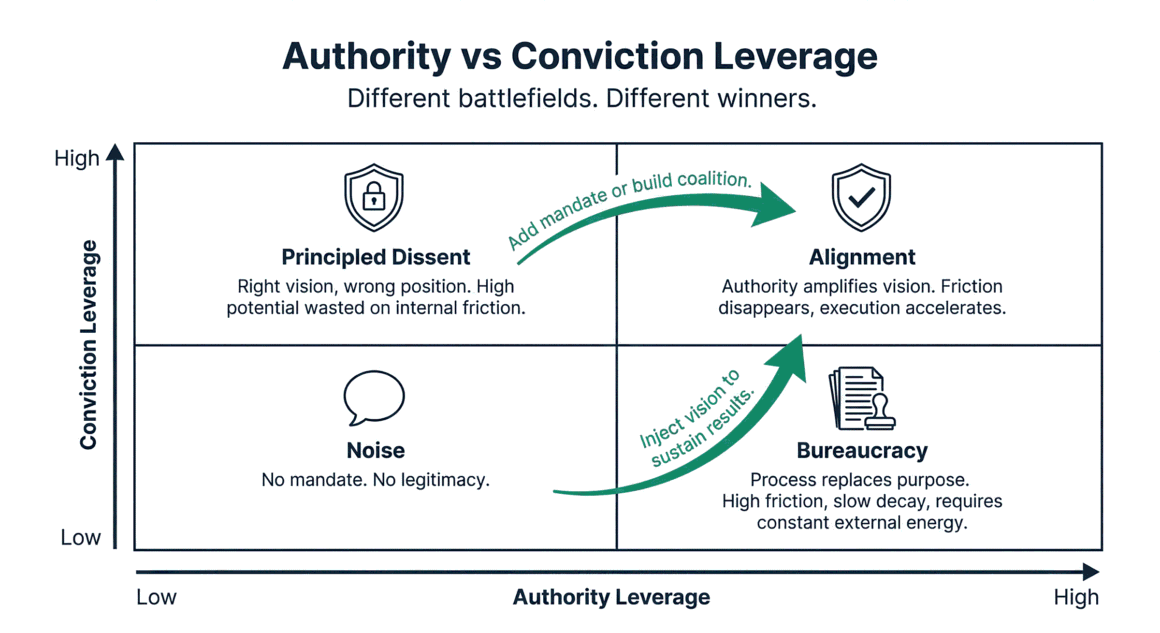

■ Authority leverage vs conviction leverage (read this or keep bleeding)

In asymmetric negotiations, two leverage systems matter:

Authority leverage

- Budget control

- Legal firepower

- Volume and access

- Escalation muscle

Conviction leverage

- Legitimacy to approve

- Reputational risk sensitivity

- Policy and ethics framing

- Ability to mobilise internal resistance

- Refusal to cooperate quietly

If you push authority levers at a conviction gate, you get withdrawal, delay, or a late veto.

■ The common sales failure pattern

You do this:

- Dump data

- Push urgency

- Threaten escalation

- Corner them publicly

They do this:

- Stop engaging

- Go quiet

- Veto later, off-stage

Pressure does not convert conviction. It hardens it.

You can “win” the meeting and still lose the contract.

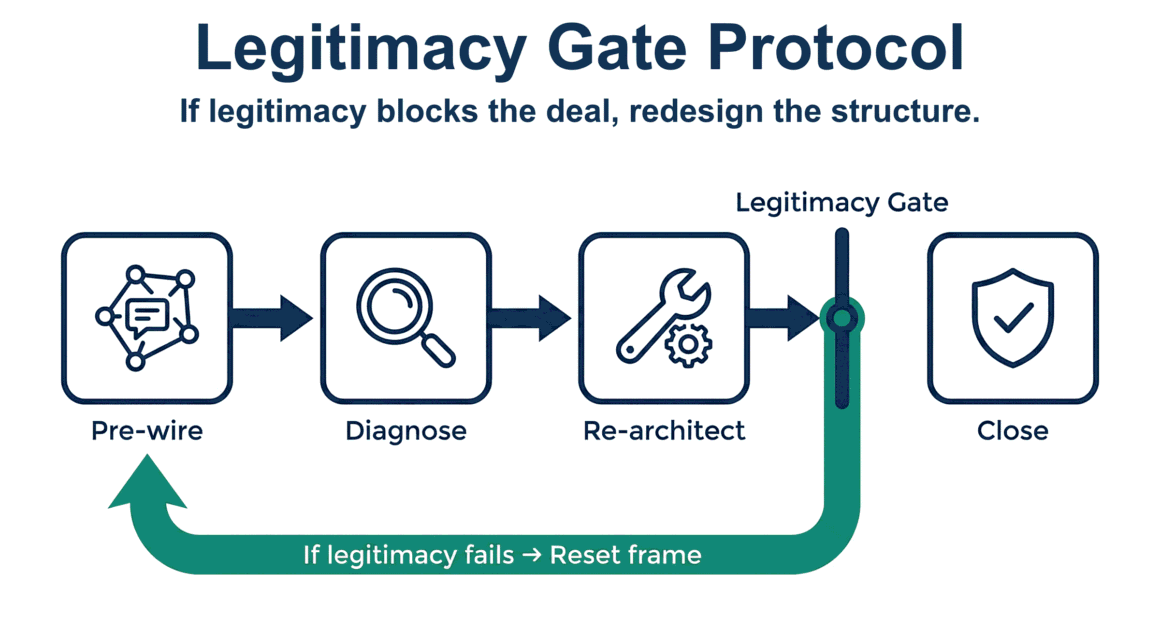

■ The Legitimacy Gate Protocol (what we install)

This is not therapy. It is interaction control and deal architecture.

Step 1: Pre-wire the gate before procurement weaponises it

Your first job is to identify who holds legitimacy power:

- Compliance, ESG, Quality, Legal, Security, Risk, Works Council, Ethics

- Or a senior operator with internal moral authority

If they can block signature, they are not a stakeholder. They are a gate.

Pre-wire actions:

- Secure their non-negotiables early

- Define what “clean to sign” means in their language

- Remove surprises from the approval chain

Step 2: Diagnose the principle, not the opinion

Do not debate price. Diagnose the constraint.

Use questions that surface the internal compass:

- “What must be true for you to sign this cleanly?”

- “Which part of the structure fails your standard?”

- “What would you need to defend this decision internally?”

You are isolating the non-negotiable legitimacy condition.

Step 3: Re-architect the deal around legitimacy

Once you have the constraint, rebuild the structure so they can support it without self-betrayal.

Real examples that stop deals:

- ESG concern: audit rights, traceability, remediation steps, termination triggers

- Fairness concern: replace “gotcha” rebates with transparent tiers plus governance

- Integrity concern: remove clauses that incentivise misreporting or gaming KPIs

- Risk concern: tighten change control, clarify performance evidence, define disruption rules

This is not “softening”.

This is risk engineering that protects margin.

Step 4: Translate value into defensible logic

They do not reject profit.

They reject undefended profit.

Make your ask legitimate:

- “This price protects continuity and reduces exposure.”

- “This clause removes ambiguity under disruption.”

- “This governance prevents rogue behaviour on both sides.”

No spin. No theatre. Clean logic.

Step 5: Control the interaction design

f you want cooperation:

- Give processing time. Do not force same-day commitment.

- Keep disagreements private. Public pressure triggers withdrawal.

- Use evidence plus narrative, not evidence alone.

Micro-script that works:

“I am not asking you to bend your principle. I am asking what structure would let you support this without compromising it.”

Step 6: ❗️Do not do these things

Avoid:

- Data dumping as if facts replace legitimacy

- Deadline threats as if urgency replaces approval rights

- Performative empathy without structural change

- Public cornering: “We need your sign-off now”

■ Field cheat sheet: symptoms and surgical moves

| Symptom | Diagnosis | Surgical move |

|---|---|---|

| ● They keep raising “principle” issues | legitimacy constraint | extract the standard, redesign governance |

| ● They go quiet after pressure | withdrawal, not agreement | reopen privately, offer processing time, remove identity threat |

| ● They dislike the incentive structure | integrity alarm | simplify mechanics, make tiers transparent, add controls |

| ● They veto late | unresolved legitimacy condition | pre-wire earlier, lock non-negotiables before trading |

■ The directive

Do not underestimate the quiet ones.

They do not negotiate your price.

They decide whether your deal is allowed to exist.

If legitimacy blocks the deal, redesign the structure.

I will map your approval chain, identify the hidden veto points, and show you exactly where margin leaks through governance, rebates, and contract mechanics.

Disclaimer: All images and video used in this article are AI-generated fictional, stylized illustrations inspired by the leadership style of the historical figure. They do not depict any real recording, appearance, or voice.